Litecoin Price Prediction: Technical Analysis and Market Factors Point to Potential Rebound

#LTC

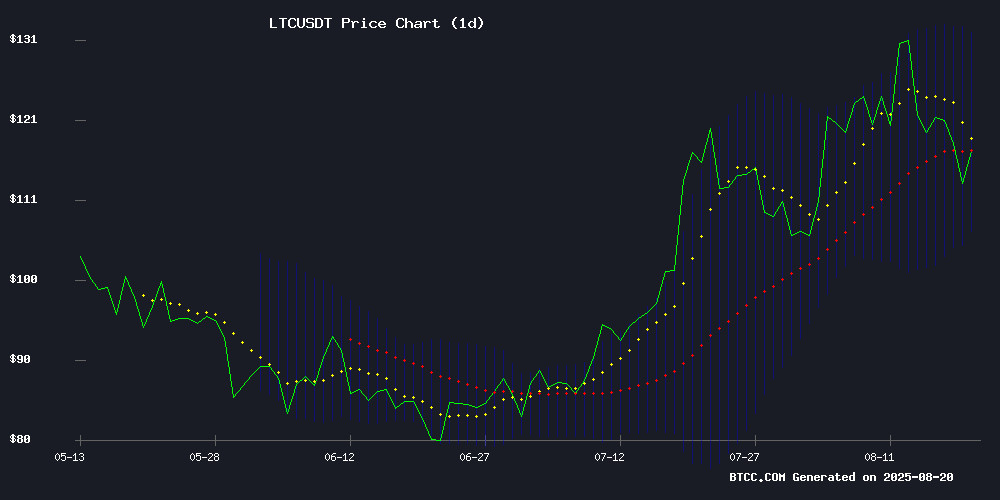

- Current price below 20-day MA suggests short-term bearish pressure

- MACD negative but histogram positive indicates potential trend reversal

- Bollinger Band position shows possible oversold conditions

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Amid Market Volatility

Litecoin is currently trading at $116.76, below its 20-day moving average of $119.26, indicating short-term bearish pressure. The MACD reading of -3.25 suggests weakening momentum, though the positive histogram of 1.94 shows some buying interest emerging. Bollinger Bands position the price NEAR the lower band at $106.65, potentially indicating an oversold condition. According to BTCC financial analyst John, 'LTC appears to be testing key support levels. A break below $106 could trigger further declines, while holding above this level might signal a potential reversal.'

Market Sentiment: Mixed News Flow Creates Uncertainty for Litecoin

Recent headlines present a complex picture for Litecoin investors. While some articles highlight 'Meme Coin Rally' momentum and 'Altcoins Gain Momentum,' others note LTC's 5% dip amid market volatility. The emergence of new presales like Pepeto and BlockchainFX suggests continued interest in the crypto space. BTCC financial analyst John comments, 'The news flow reflects typical crypto market dichotomy - both optimism and caution coexist. Regulatory developments around XRP ETFs could indirectly benefit LTC as attention shifts to established altcoins.'

Factors Influencing LTC's Price

Meme Coin Rally: XRP and Litecoin Gain Momentum as Pepeto Presale Emerges

XRP is showing renewed strength amid a broader market recovery, while Litecoin's price action benefits from record-high mining difficulty—a bullish indicator of network participation. Analysts suggest LTC could target $260 if current momentum holds.

Meanwhile, Pepeto (PEPETO) is gaining attention as an Ethereum-based memecoin presale with live utilities, including zero-fee trading and cross-chain functionality. With $6.2 million raised and staking rewards touting 243% APY, speculation mounts around its Tier 1 exchange potential.

XRP Investors Shift Focus to Cloud Mining Amid Price Stagnation

As XRP struggles to regain momentum following a recent pullback, a segment of holders is pivoting toward alternative yield opportunities. OurCryptoMiner's cloud mining contracts—promising daily returns of $3,500 to $17,900—are attracting capital from investors seeking to monetize idle XRP holdings without hardware overhead.

The platform converts deposited XRP into hashing power, distributing profits in BTC, USDT, or XRP. Strategic partnerships have expanded functionality beyond XRP's traditional payments role, with McAfee and Cloudflare providing security infrastructure. Referral incentives and zero management fees further bolster the value proposition.

Litecoin Dips 5% Amid Market Volatility as BlockchainFX Presale Gains Momentum

Litecoin retreated to $116, extending its recent downturn as traders shift focus to emerging opportunities. The BlockchainFX ($BFX) presale has emerged as a focal point, raising $5.6 million from 5,300 participants ahead of its planned exchange listing at $0.05—a 150% premium to current presale levels.

The project combines multi-asset trading with a revenue-sharing model, redistributing 70% of platform fees to token holders. CertiK-audited and already processing 10,000+ daily users, the platform offers staking rewards up to 90% APY during presale. Historical parallels are drawn to Solana's early trajectory, with analysts projecting $BFX could reach $0.10-$0.25 post-launch.

Japan's 10-Year Bond Yield Surge Sparks Risk Asset Concerns

Japan's benchmark 10-year government bond yield climbed to 1.61%, marking its highest level since 2008. The move reflects growing investor anxiety over fiscal policy and could ripple through global bond markets, tightening financial conditions and dampening appetite for riskier assets like cryptocurrencies and equities.

The yield spike followed a weak auction of 20-year JGBs, with longer-dated debt also hitting multi-year highs. Veteran lawmaker Taro Kono called for BOJ rate hikes to address yen weakness, echoing recent remarks from U.S. Treasury officials. This shift from Japan's long-standing ultra-loose monetary policy may remove a key pillar of global liquidity that has supported risk assets for years.

Dogecoin Faces Selling Pressure Amid 51% Attack Concerns

Dogecoin's price dropped 5% following a community vote by Qubic blockchain to target the network for a potential 51% attack. The sell-off accelerated between 13:00-15:00 UTC on August 19, with trading volume doubling the 24-hour average as panic selling took hold.

The Qubic group recently demonstrated its capability by disrupting Monero's network, though Dogecoin's merge-mining with Litecoin provides stronger security. Despite the downturn, large holders accumulated 680 million DOGE in August, signaling divergent views on the asset's resilience.

Futures markets reflected declining confidence, with open interest falling 8% as traders priced in short-term risks. The episode highlights the evolving security challenges facing proof-of-work cryptocurrencies in an increasingly sophisticated threat landscape.

Spot XRP ETFs Could See Approval by October 2025, Predicts Wealth Manager Nate Geraci

Nate Geraci, president of NovaDius Wealth Management, forecasts regulatory approval for spot XRP exchange-traded funds within the next two months. The SEC recently delayed decisions on multiple XRP ETF applications, including proposals from Grayscale and CoinShares, but Geraci interprets these postponements as procedural rather than prohibitive.

The CLARITY Act's passage in the U.S. House signals growing legislative support for crypto investment vehicles. Geraci extends his optimistic outlook to altcoin-based ETFs, predicting Solana and Litecoin funds may follow XRP's regulatory breakthrough. Market participants await these developments as potential catalysts for broader institutional adoption.

Trump Family Expands Crypto Bets as Thumzup Pivots Into Dogecoin Mining

Thumzup Media Corp. (TZUP), backed by Donald Trump Jr. as a major shareholder, announced its acquisition of Dogehash Technologies, Inc. in an all-stock deal valued at $153.8 million. The transaction will see Dogehash shareholders receive 30.7 million Thumzup shares, with the combined entity rebranding as Dogehash Technologies Holdings, Inc. and listing on Nasdaq under the ticker XDOG.

Dogehash operates 2,500 Scrypt ASIC miners across renewable-powered North American data centers, focusing on Dogecoin (DOGE) and Litecoin (LTC) block rewards. Unlike competitors that purchase coins outright, Dogehash owns its infrastructure, providing cost-efficient exposure to mining rewards. The deal follows Thumzup's $50 million stock offering in July, earmarked for mining expansion and digital asset accumulation.

The Trump family continues to deepen its crypto footprint. Earlier this year, Eric Trump and Donald Jr. partnered with Hut 8 to launch American Bitcoin, which operates over 60,000 miners. Thumzup plans to leverage Dogecoin's DogeOS LAYER 2 for DeFi staking, aiming to enhance miner returns beyond standard block rewards.

11 XRP ETFs Await SEC Decision: Approval Timeline and Market Implications

The SEC faces mounting pressure as 11 XRP ETF applications await review, with Bloomberg analysts assigning a 95% probability of at least one approval. Grayscale's deadline for its XRP Trust conversion decision on October 18 looms as a potential catalyst.

XRP's legal clarity gives it an institutional edge. A federal court's ruling that XRP isn't a security on secondary markets contrasts sharply with ongoing regulatory uncertainty surrounding competitors like SOL and LTC. This distinction may accelerate approval timelines.

Market structure appears poised for transformation. Nate Geraci of NovusDius Wealth Management anticipates crypto ETF floodgates opening within 60 days, with XRP likely leading the altcoin cohort. The pending Clarity Act in the Senate could create a domino effect for staking products and additional altcoin ETFs.

Altcoins Gain Momentum: Expect A Surge Soon!

Recent evaluations from Coinbase and Pantera Capital suggest a bullish phase for altcoins is imminent, with September marking the potential start of a broader token rally. Market conditions are shifting, indicating a departure from Bitcoin-centric growth patterns.

Pantera Capital's latest report highlights altcoins outperforming Bitcoin in recent price surges. Historical data shows altcoins contributed 66% of total growth during the 2015-2018 cycle and 55% from 2018-2021. The current cycle's altcoin contribution remains a critical metric to watch.

Institutional and individual investor interest in altcoins is rising, signaling a potential paradigm shift in cryptocurrency market dynamics. The next wave of growth may be driven by these alternative digital assets rather than Bitcoin alone.

How High Will LTC Price Go?

Based on current technical indicators and market sentiment, LTC could potentially reach $125-130 in the near term if it breaks above the 20-day MA resistance. The Bollinger Band upper limit at $131.87 represents a key resistance level. However, BTCC financial analyst John cautions that 'market volatility and broader crypto sentiment will be crucial determinants. Investors should watch for sustained volume increases and positive regulatory developments that could drive prices higher.'

| Support Levels | Resistance Levels | Key Indicators |

|---|---|---|

| $106.65 (Lower Bollinger) | $119.26 (20-day MA) | MACD: -3.25 |

| $110.00 (Psychological) | $131.87 (Upper Bollinger) | RSI: Neutral Zone |